by Jane Cowles

by Jane Cowles

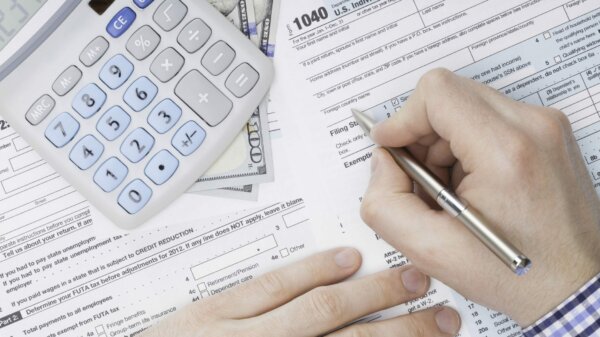

Are you a self-employed artist getting ready to file taxes? If you are an artist who relies on the income you earn from creating art–not one who makes art as a hobby–you can deduct the amounts you spend to make art from all sales.

Think of a Schedule C as a spreadsheet where you enter all the expenses that you incur in making art and then subtract these amounts total from all of the money you receive from sales throughout the year. Detailed records are the key to completing this Schedule. Get an accordion file for receipts and divide it into categories: a slot for income and a slot for each category of receipts listed below.

Materials include anything used to create a finished work of art–paint, clay, and even the cost of digital programs like illustrator, photoshop, we transfer, and drop box.

Travel includes trip expenses and the cost of miles driven to galleries, exhibitions, and clients.

Memberships are the fees paid to join a museum, gallery, film center, or artist club.

Subscriptions are the amount paid for art journals, art magazines, and other art publications, whether print or online.

Gallery Fees include entry fees to submit art to a juried competition and to exhibit artwork in a gallery space.

It Takes a Village to cover our villages.

Local news matters now more than ever. Nyack News and Views has covered news, arts and culture in and near the Nyacks for a dozen years. During the COVID-19 crisis, we’ve doubled down on content, bringing readers service-oriented news you can use.

Local news matters now more than ever. Nyack News and Views has covered news, arts and culture in and near the Nyacks for a dozen years. During the COVID-19 crisis, we’ve doubled down on content, bringing readers service-oriented news you can use.

We need your help – NOW – to continue this work. Please consider making a one time or sustaining donation to Nyack News And Views. Thank You!

Website Hosting & Design Fees

Meals – Save receipts when dining out with gallery owners, clients, prospective clients, and fellow artists and designers. Also, keep track of the cost of a gallery opening.

Studio Expenses include the amount spent to rent a studio. If you have a home studio, keep track of the pro-rata portion of utilities, rent, and mortgage payments.

Advertising includes the cost of magazine and other print advertisements and promoted posts on social media.

Misc. – When unsure, keep the receipt just in case and ask your accountant or a tax professional.

This method is an organized way to keep track of all the expenses incurred throughout the year. To take it a step further, enter each item of income and expenses in an Excel spreadsheet and print it out at the end of the year. When you give your accountant an organized file of your income and expenses, she will have a smile on her face as she prepares your return.

BONUS POINT: Ask your accountant about an additional 20% deduction that may apply to you.

This information is provided for general informational purposes only. No information contained in this article should be construed as legal advice and does not establish an attorney-client relationship.

Jane Cowles is an attorney focusing on contract law, business law (start-up, planning and restructuring), tax law and art law. She has over 10 years experience working with business transactions at boutique law firms and as a tax advisor for Ernst & Young. She has a solo practice in Rockland County and advises creative professionals, small businesses, and entrepreneurs. She is available to help with all the challenges individuals and business currently face with the COVID19 pandemic. For more information, visit her website www.janecowlesattorney.com or email her at jane@janecococowles.com. She is offering 30 minute FREE consultations by telephone or video conference.