![]()

By Doug Foster

I would like to explain the budget process over the last couple months. I am as disappointed as anybody with an 8.5% tax increase, but the story for me is how we spent weeks of our time with all our experience and creativity to keep the tax increase so LOW. We are in a perfect storm of reduced revenues and increased fixed costs, all while we have no cash balance, are running a $250,000 deficit, and are deferring infrastructure maintenance. A realistic budget with no increased discretionary expenditures would have been a 14% tax increase, and that wouldn’t address the deficit, infrastructure, or cash balance.

I am also disappointed that we did not provide the public more information about the process. I believe strongly in open and transparent government and wanted to provide more information until now (The Mayor’s proposed budget is now on the Village website). The budget has been in a constant state of change as we have looked for creative ways to find revenue and reduce costs.

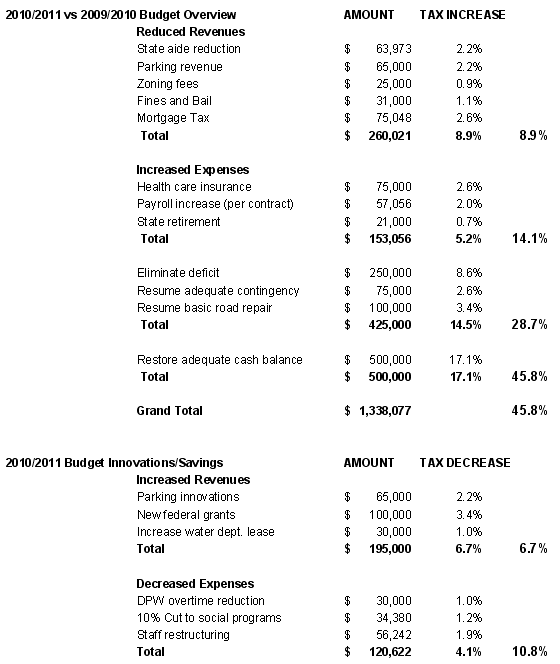

We have pursued many opportunities including land sales, many grants, and other creative revenue generating tools to get out of the budget hole we are in. The following table shows how a do-nothing budget would be a 14% tax increase, and getting rid of our deficit and restoring basic infrastructure improvements would result in a 29% increase, and building a “rainy day” fund would take a 46% tax increase. That would make us whole.

Below is a spreadsheet with the first table outlining the major items that are driving our budgetary problems, and the second table highlighting several items to increase revenues or decrease expenses. To see the entire budget, click HERE.

Doug Foster is a Village Trustee